The Cloud is ever-looming overhead and getting larger as time goes on. More and more businesses are turning to Cloud software and solutions. This means that the software you, your team, or your outsourced partners use isn’t hosted on any one physical computer that you have in the office, but rather on servers in an entirely different location. This means that you can access that software across the internet and data is sent back and forth from those servers, which are known as “the Cloud.”

The Cloud is transforming how we do business, regardless of how large or small the business is. One of the ways it’s doing that is through Cloud accounting with the help of tools like Xero bookkeeping. But before you jump into the Cloud feet first, let’s make sure it’s a wise decision by looking at some of the pros and cons.

Pros: It’s efficient, simple, and convenient

Pros: It’s efficient, simple, and convenient

With Cloud accounting tools like Xero accounting, you don’t have to wait on lengthy install and setup periods to start with your bookkeeping processes. They are hosted entirely online, so all you need to do is register, input a few quick details, log in and start making use of them. You don’t have to go about installing it anew on every new system, so it’s much easier for all members of your team to start making use of it. You can focus less on the logistics and more on learning how to most effectively use the software.

Cons: A lack of specialised tools

The most popular Cloud accounting tools, like Xero accounting, provide all the functionality that most small businesses could want for. However, for more specialised businesses like construction, they may not have all the features that you need. There is a growing diversity within the Cloud accounting market, however, so it’s worth doing your research and seeing what’s out there. It’s only reasonable to expect that more specialised options will become available as the market continues to grow, too.

Pros: Improved security

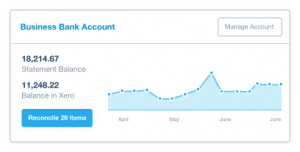

The idea of someone gaining unauthorised access to your accounts is enough to make most business owners scream in terror. If all the accounting data is sitting there on one device, ready to be lifted at any point, it can put your business at serious risk. Few businesses make it more than two years after a major data breach, after all. However, top-of-the-line tools like Xero bookkeeping ensure enhanced security for all their services.

Security features like access control, user authentication, strong data encryption, and network protection means that their systems are much harder to crack. The data centres/servers are stored in secured, remote locations, as well, so your chances of suffering a breach are much reduced.

![]()

Cons: Demands strong security practices from your team

Yes, Cloud accounting is much safer, but that’s only true if you put the practices in place that ensure you and your team aren’t leaving your systems vulnerable. Every business and employee have some responsibility to ensure they are doing their part in keeping that crucial data secure. This might include teaching practices such as a password safety and not leaving workstations logged in and unattended.

Those in more senior, administrative roles are wise to make use of the access control features, to ensure that every individual employee or team only has access to the parts of the Cloud accounting system that is directly relevant to them. It requires a little effort to protect but it is worth it.

Pros: You don’t have to pay for installation, maintenance, and upgrades

The lack of a lengthy installation and setup process doesn’t only save you time. It might also save you money. Most Cloud accounting tools run on a software-as-service model, meaning you’re paying a subscription over time to make use of them. On the contrary, with software that is built or installed onto your systems, you may be constantly forking out cash to ensure they’re in good working order.

Business owners who have their own software on their own systems have to not only pay for the initial product but the ongoing maintenance and upgrades that they need. With Cloud accounting, the software development is handled entirely in-house by the provided and, so, they eat the costs, as well. All you have to pay for is access to the software.

Cons: It’s an ongoing cost

While it may be cheaper to use Cloud accounting, it’s still a constant, ongoing cost that has to become part of your regular overheads. Many Cloud accounting providers offer some flexibility in how and when you pay, but all of them require regular payments. For some packages, this might mean that Cloud accounting is more expensive in the long-term, so you have to make sure that you choose your service carefully and know the costs before you dive in.

Pros: Makes it much easier to move to a paperless system

Since Cloud accounting is handled entirely digitally, that means that it’s much easier to stop relying on a paper trail as long as your arm. Not only can you save on the costs of paper, but the costs of stocking and maintaining printing machines, and both the money and space spent on storing all your accounts physically. The Cloud allows you to save reports and documents on your own computer, while the remote data centres/servers act as a backup, so you don’t necessarily need a physical copy.

Of course, most businesses will always rely on some level of paper storage, but Cloud accounting can at least help you reduce it.

Cons: Online only

You need an internet connection to access the Cloud. While this offers some benefits, as we have explored and will dive deeper into in the next point, it is also a potential weakness. If your internet cuts out at the office, traditional accounting software allows you to keep working with it. With Cloud accounting, however, you will be unable to use the tool effectively. This problem can be mitigated by the fact that you can always simply move somewhere that provides a different internet connection, but if that isn’t readily accessible, it can mean significant potential downtime. The fact you have to use it online means that Cloud accounting can also be quite bandwidth hungry, so you need to make sure that your current internet connection can handle it without issue.

Pros: You can use it from anywhere

Tying back into the accessibility and convenience, the simple fact that you can use Cloud accounting tools like Xero bookkeeping from anyone is one of its greatest benefits. You can be on any device, on the phone, laptop, PC or tablet. You can be in your office, your home, in a café, or even away on vacation and it’s accessible so long as you have the right login credentials. It’s perfect for the business that’s always on the move or is looking to rely on remote workers. Multiple teams from across the country can collaborate together on the same account with no issue.

Is it time to move to the Cloud?

Like all IT solutions, the Cloud does have its risks, but many business owners would agree that the risks are not only much smaller but are mitigated by the fact that if, for instance, your internet goes out, you can simply move to another location and keep using your Cloud accounting software.

Most importantly, Cloud accounting makes it much easier to come out of the shoebox and paper records, creating a much more efficient, secure system that’s significantly more accessible and cost-effective for you and your team.

Pros: It’s efficient, simple, and convenient

Pros: It’s efficient, simple, and convenient